[ad_1]

Intuit QuickBooks is known for its accounting software, but it also offers a suite of other business tools, including QuickBooks Payroll. While QuickBooks Payroll is a trusted brand name, it comes with a slightly higher price tag and added fees for extra services. OnPay boasts a single affordable pricing plan — but can its features stack up against QuickBooks?

OnPay is less scalable than QuickBooks Online Payroll, but it includes more payroll and HR features at a more affordable price point and with fewer add-on fees than QuickBooks Payroll. Along with competitors like Gusto and SurePayroll, OnPay easily offers the best value for price of any payroll software provider.

However, QuickBooks Payroll is a good option for businesses that already use QuickBooks Online to manage their books and that don’t mind paying extra to integrate QuickBooks’ top-of-the-line benefits.

In this OnPay vs. QuickBooks Payroll review, we dive into each payroll software solution’s strengths, weaknesses, features and pricing to help you compare these two payroll software platforms.

Recommended Alternative: GustoSPONSOREDGusto is easily the most popular payroll software for small and midsize businesses, which makes it one of QuickBooks’ and OnPay’s top competitors. With automatic payroll runs, optional employee benefits, and built-in time tracking options, it’s the ideal alternative to either OnPay or QuickBooks. |

QuickBooks Payroll vs. OnPay: Comparison table

| QuickBooks Payroll | OnPay | Gusto (sponsored) | |

|---|---|---|---|

| Pricing | Starts at $45/mo. + $5/employee/mo. | Starts at $40/mo. + $6/person/mo. | Starts at $40/mo. + $6/person/mo. |

| Benefits management | Yes | Yes | Yes |

| Mobile app for employers | No | No (mobile-friendly site) | No (mobile-friendly site) |

| Automated tax filing | Yes | Yes | Yes |

| Third-party integrations | QuickBooks Online | 12+ | Dozens |

| Built-in time tracking | Yes (additional cost) | Third-party integrations | Yes |

| HR compliance tools | Yes | Yes | Yes |

| Same-day direct deposit | Yes (Premium and Elite plans only) | No | No |

| Try QuickBooks Payroll | Try OnPay | Try Gusto |

QuickBooks Payroll vs. OnPay: Pricing

QuickBooks Payroll

QuickBooks Payroll offers three pricing tiers to choose from:

- Core: Starts at $45 per month plus $6 per employee per month.

- Premium: Starts at $80 per month plus $6 per employee per month.

- Elite: Starts at $125 per month plus $8 per employee per month.

Like other QuickBooks products, QuickBooks payroll allows you to choose between a 30-day free trial or 50% off the first three months. You must choose one or the other, but not both.

For more information, see our full QuickBooks payroll review and our roundup of QuickBooks payroll alternatives.

OnPay

OnPay offers a single pricing plan: $40 per month plus $6 per employee per month. This is pretty comparable to the cheapest QuickBooks Payroll plan, but it covers everything OnPay has to offer — no need to upgrade to a higher plan for more features. OnPay also offers a 30-day free trial so that you can try out the service before committing.

For more information, see our full OnPay review and our roundup of OnPay alternatives.

QuickBooks Payroll vs. OnPay: Feature comparison

Payroll (Winner: OnPay)

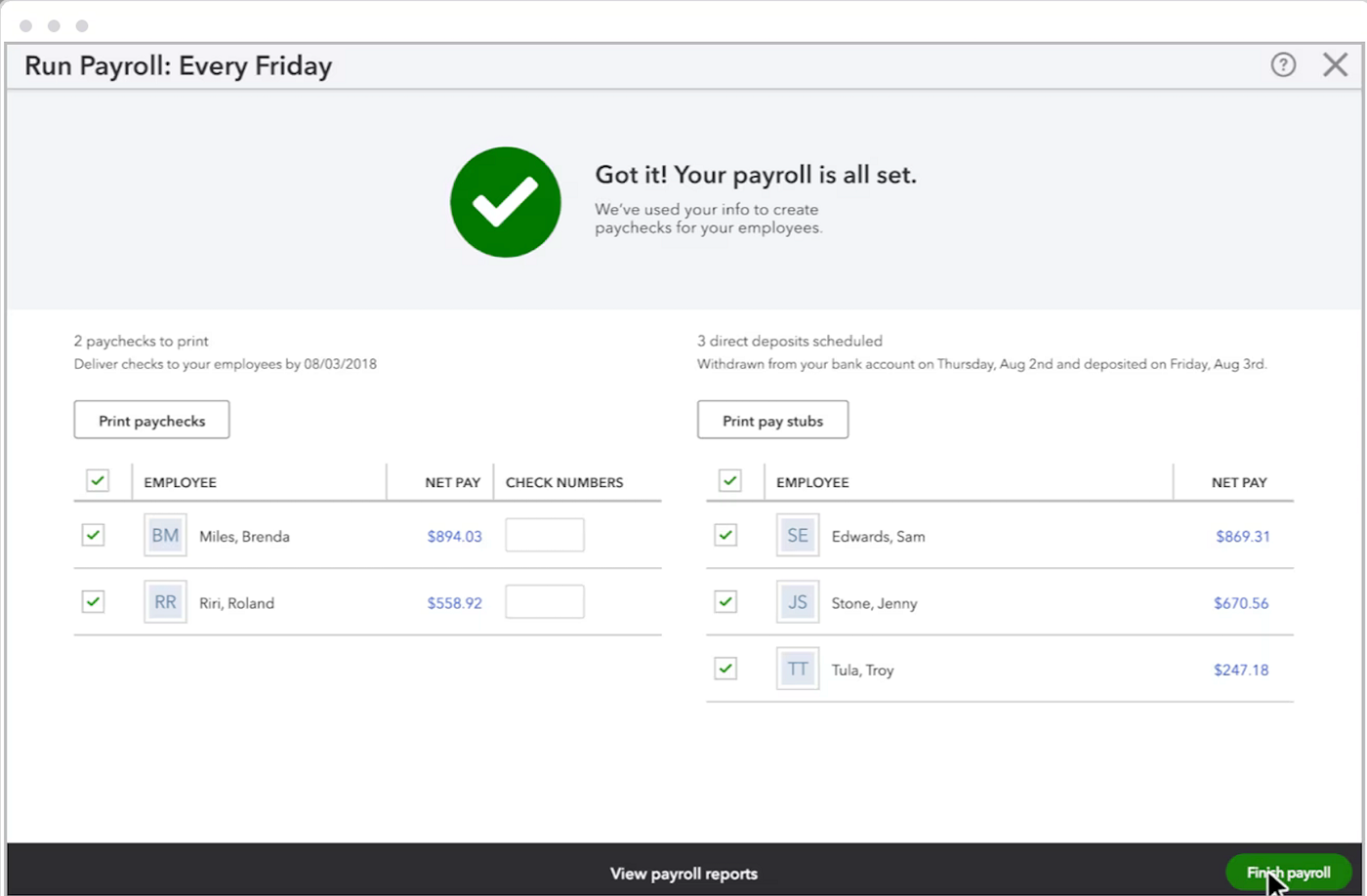

QuickBooks’ payroll software offers both unlimited payroll runs as well as the option to set up auto payroll so that you don’t have to run it manually. QuickBooks will also calculate, file and pay your payroll taxes for you so that you don’t have to worry about it. Once tax season comes, you can generate and file unlimited 1099 forms for your employees. It also offers the option for same-day direct deposit so that your employees can get paid faster. However, you will need to upgrade to the most expensive Payroll Premium plan to get same-day direct deposit.

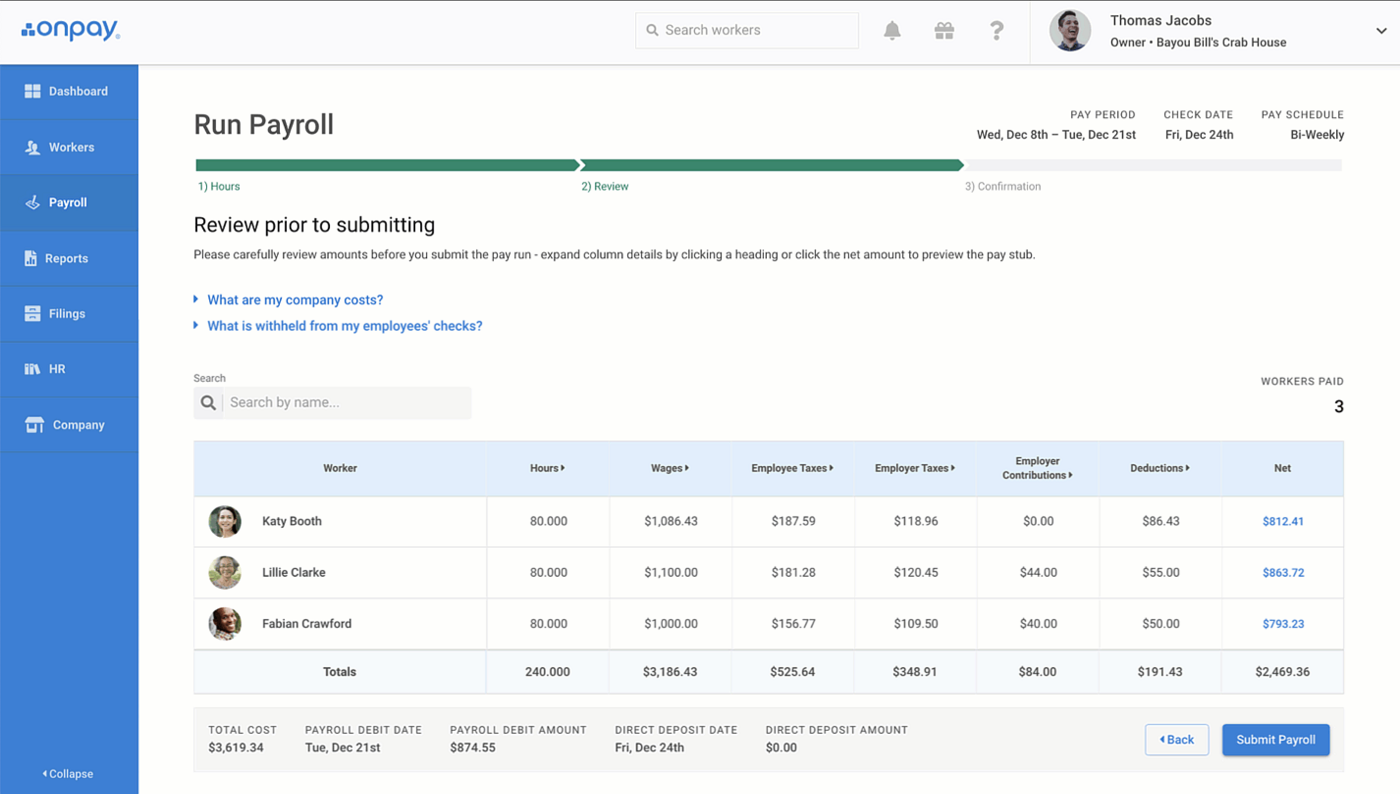

OnPay offers unlimited payroll runs as part of its single pricing plan. But it does not offer automatic payroll, so you’ll have to log in and run it each time you want to pay your employees. OnPay also handles calculating and filing federal, state and local taxes as part of its payroll software features. It also allows you to generate and file W-2s and 1099s once tax season rolls around. You can pay employees by direct deposit, debit card or check, and the turnaround on direct deposit is usually between two and four days — longer than QuickBooks.

Crucially, OnPay offers unlimited multi-state payroll runs at no additional fee. It also includes more payroll features at a lower cost than QuickBooks Payroll does, such as wage garnishment, multiple employee pay options (direct deposit, check, and debit card all included), end-of-year W-2 and 1099 form generation at no additional charge, and more.

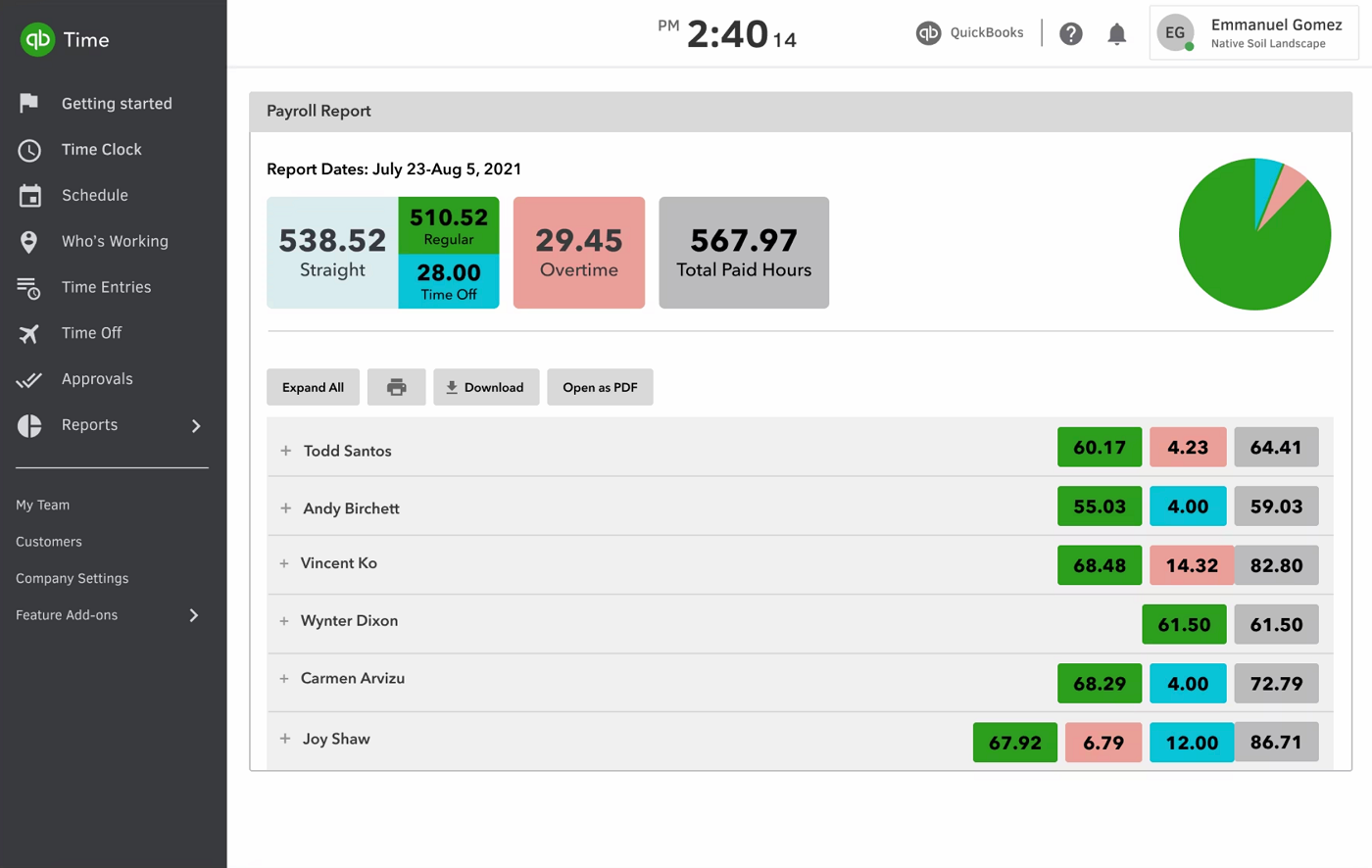

Time management (Winner: QuickBooks Payroll)

With QuickBooks Payroll, free integrated time tracking isn’t available with the cheapest plan. Instead, you must upgrade to at least the Payroll Core plan if you want to enter employee time by client or project and automatically add those entries to invoices. If you want to track time on the go using the QuickBooks Workforce app, then you’ll need to upgrade to the Payroll Premium plan. You can also opt to add on the standalone QuickBooks Time module — which starts at $40 per month plus $10 per user — to create schedules, manage time off, set up geofencing and more.

OnPay is mostly focused on PTO management, offering the ability to set custom paid time off policies and up to three accrual tiers. Employees can make requests and managers can approve them all within the app, and employees can also view their PTO calendar and reminders whenever they’d like. However, OnPay does not offer support for timesheets or scheduling, so you’ll need to rely on an outside tool for that. But if you’d still like to go with OnPay, we have recommendations for the best time tracking apps to get you started.

Benefits administration (Winner: OnPay)

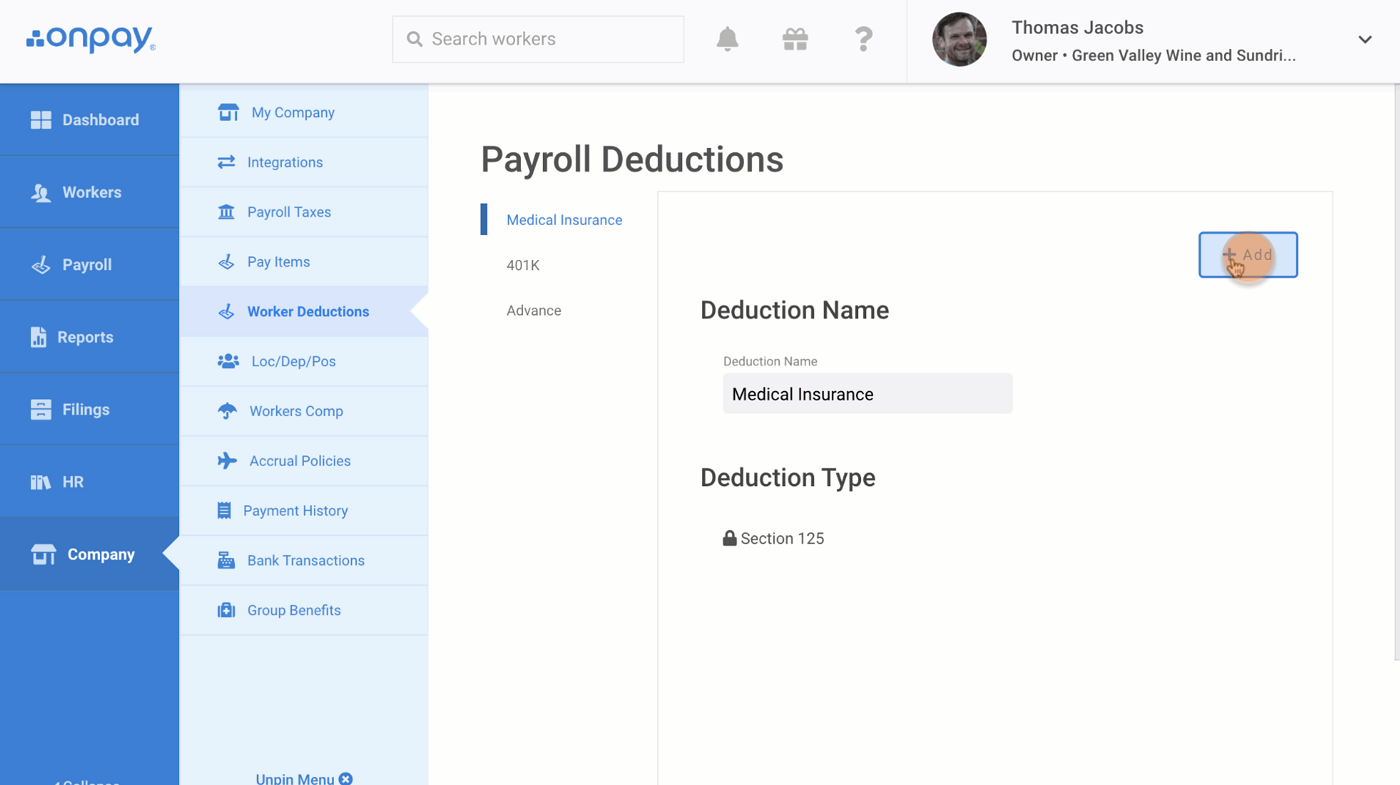

QuickBooks partners with SimplyInsured to offer medical, dental and vision insurance packages. It also offers 401(k) plans through Guidelines and worker’s compensation policies through NEXT insurance. These benefits administration features are offered on all pricing plans, but you may be charged an extra monthly fee if you decide to take advantage of them. However, as a plus, QuickBooks will handle all the calculations and deductions for you and add them directly into your payroll software.

OnPay offers health and dental benefits in all 50 states. It connects with most major providers, including Humana, CIGNA, Blue Cross, Blue Shield, Aetna and United Healthcare. It also provides pay-as-you-go workers compensation insurance plans, as well as the option to offer 401(k) savings plans to your employees. You can also choose to add on other benefits, such as life insurance, disability insurance, liability insurance and HSA and FSA accounts. If you already have your own benefits set up, OnPay can also ask your broker of record to administer any existing plans, if you would like.

QuickBooks Payroll pros and cons

Pros of QuickBooks Payroll

- Seamless integration with QuickBooks accounting.

- Many different payroll reports to choose from.

- More robust time tracking and scheduling features.

- Auto payroll option.

Cons of QuickBooks Payroll

- More expensive than OnPay.

- Certain features confined to more expensive plans.

- Extra fees for benefits administration.

OnPay pros and cons

Pros of OnPay

- Single transparent pricing plan with minimal added fees.

- Administer health and dental benefits in all 50 states.

- Unlimited multi-state payroll runs supported.

- Free white-glove setup and account migration.

- No add-on fees for benefits administration, workers’ comp, wage garnishment or multi-state payroll.

Cons of OnPay

- No time tracking or scheduling included.

- No automatic payroll option.

- Single pricing plan may not be scalable for all businesses.

Should your organization use QuickBooks Payroll or OnPay?

Choose QuickBooks Payroll if . . .

- You have the budget to pay for more expensive payroll software.

- You want a lot of extra features like time tracking and scheduling.

- You need automatic payroll.

- You already use QuickBooks Online for accounting and want to stick with the same software.

- You’re okay with paying extra fees for benefits administration, time tracking (with the cheapest plan), multi-state payroll and more.

Choose OnPay if . . .

- You like the idea of a single transparent pricing plan.

- You’re a smaller business on a budget.

- Automatic payroll doesn’t matter to you.

- You’re willing to use a third-party solution for time tracking and scheduling.

- You don’t want multiple scalable pricing plans.

- You run payroll in multiple states and don’t want to pay extra to do so.

Methodology

To compare OnPay vs. QuickBooks Payroll, we consulted product documentation and user reviews. We considered features such as payroll, benefits administration, time and attendance and more. We also weighted factors such as pricing, user experience, customer service and transparency.

[ad_2]