[ad_1]

Payroll reports serve many purposes, from double-checking payroll tax calculations to actually filing your business taxes. There are multiple kinds of payroll reports and related forms to choose from, which can be a little confusing to navigate.

Read on to learn which payroll reports must be filed with the United States government and how often.

What is a payroll report?

A payroll report is a summary document that includes information such as pay rates, hours worked, wages earned, benefit deductions made, taxes withheld and paid time off remaining. Payroll reports are used to verify tax payments and other financial information.

Benefits of payroll reports

Payment accuracy

Regularly checking your payroll reports will help you confirm that all payments are accurate and detect early warning signs in the event of fraud.

Legal and tax compliance

Consistent, correct tracking of wages and deductions will make it easier to quickly file error-free taxes at quarterly and annual intervals, reducing your risk of an audit or fine.

Record keeping

Frequent payroll reports create a transparent paper trail that will help you quickly gather all necessary information in the event of a potential audit.

PTO tracking

Payroll reports will help you see how much paid time off employees are taking, whether it’s too much or not enough.

Budgeting and financial management

Payroll reports are one of many different types of reports that can assist with accurate budgeting and forecasting, improving the financial health of your business over time.

Types of payroll reports employers need to file

Form 941

Form 941 is called the Employer’s Quarterly Federal Tax Return. It includes information like wages paid to employees, federal income tax withheld from employees’ wages, and both employee and employee contributions to Medicare and Social Security taxes.

Form 944

Small businesses that are allowed to file taxes annually (as opposed to quarterly) will file Form 944, the Employer’s Annual Federal Tax Return, as opposed to Form 941. Businesses that are allowed to file Form 944 typically owe less than $1,000 for federal income, Medicare and Social Security taxes for the entire year.

Form 940

Form 940 is called the Employer’s Federal Unemployment Tax Act (FUTA). Payments are usually due once a year, on January 31 of the following calendar year.

Form W-2

Form W-2 is called the Wage and Tax Statement, and it lists total gross wages, some tax deductions and benefits for each employee. Employees need this form to file their individual taxes, which is why employers must provide copies of Form W-2 to employees and all applicable governments by January 31 of the following calendar year.

Form W-3

Form W-3 is called the Transmittal of Wage and Tax Statements. It summarizes all of a business’ wage and tax statements for the Social Security administration. Form W-3 must be submitted alongside Form W-2 on January 31. Forms W-2 and W-3 should not be confused with Form W-4, which is a different document that is required to run payroll in the first place.

State payroll reports

Each state has its own laws about when payroll reports must be filed and what forms must be used for filing. Consult with your state’s laws to ensure you have the most up-to-date information and deadlines.

Local payroll reports

Some cities and counties also charge additional income tax, which necessitates the filing of additional payroll reports and forms. Due dates may be annual or quarterly — consult with local laws to determine whether you must file additional reports.

Types of other payroll reports

Payroll summary reports

These reports show high-level information such as gross and net wages and tax withholdings for a certain date range. Payroll summary reports can be created for individuals, teams, departments or the entire organization.

Payroll detail reports

This is a more detailed report that shows line-by-line contribution and compensation information, usually for a single employee.

Payroll tax liability reports

These reports show how much payroll taxes employers have withheld from employee wages, how much they’ve paid government agencies and how much they still owe.

Retirement contributions

This report summarizes contributions made to retirement accounts by both employees and employers.

Paid time off

These reports show how much time employees have taken off for the year to date and how much PTO they have remaining on their balance.

Workers’ compensation

These reports are used to accurately calculate workers’ compensation insurance premiums based on the current total payroll amount.

Payroll service charges

This report summarizes the costs associated with the payroll service provider, such as software costs and payroll processing fees.

Payroll report example

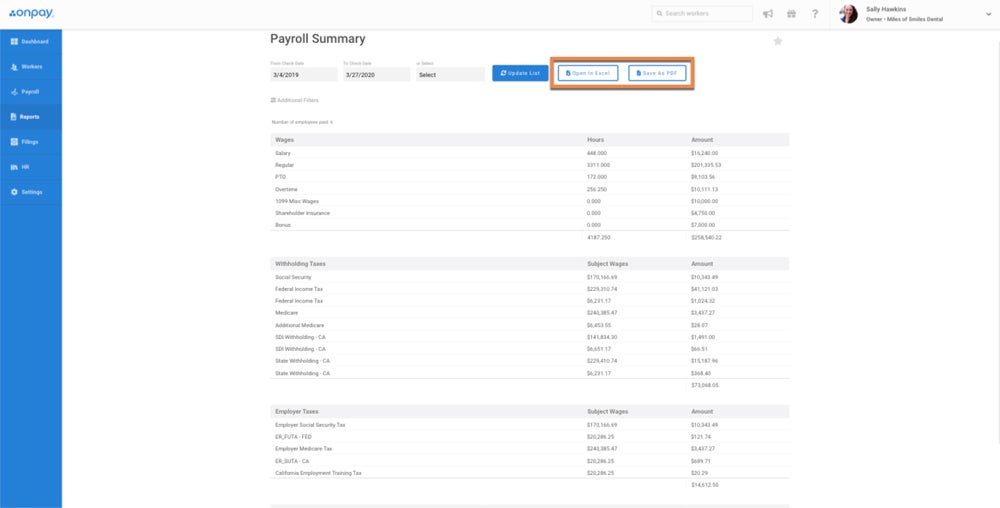

This payroll report example from OnPay shows high-level information for the entire small business, which consists of six employees. As you can see, it breaks out wage, tax and PTO information each on its own line so that the business owner can clearly see how much has been paid and what is still owed.

How to run a payroll report

Most payroll software platforms make it extremely easy to generate payroll reports. While each has its own unique interface, most do follow the same basic steps to generate a payroll report:

- Log in to the payroll software.

- Navigate to the reports menu.

- Select the payroll or tax report that you need.

- Make adjustments to the year, payroll schedule or employees as necessary.

- Generate the report, then export, share or print it for your records.

Frequently asked payroll report questions

How do I make a payroll report?

To create a payroll report, navigate to the report section of your payroll software. Select the payroll report, set parameters for the dates and employees, then generate the payroll report and share it as needed.

What is a monthly payroll report?

A monthly payroll report typically displays wages paid to employees, federal income tax withheld from employees’ wages, and both employee and employee contributions to Medicare and Social Security taxes for the period of one calendar month. It may also include additional information, such as PTO balances.

What payroll reports are due quarterly?

Form 941, the Employer’s Quarterly Federal Tax Return, is the only federal return that must be filed quarterly. Check with state and local governments to see if there are additional reports that you need to file quarterly.

What payroll reports are due annually?

The following payroll reports are due annually:

- Form 944, Employer’s Annual Federal Tax Return.

- Form 940, Employer’s Annual Federal Unemployment Tax Act.

- Form W-2, Wage and Tax Statement.

- Form W-3, Transmittal of Wage and Tax Statements.

- Form 1099-NEC, Nonemployee Compensation.

For more information, check out our guide that explains when payroll taxes are due.

What are payroll reports for the self-employed?

As a self-employed person, you will likely receive Form 1099-NEC from your clients as opposed to a Form W-2. You will use the information to file an annual tax return. You will also likely be required to file quarterly estimated tax payments throughout the year.

[ad_2]